*Great Pacific Gold is a client of the Gold Telegraph

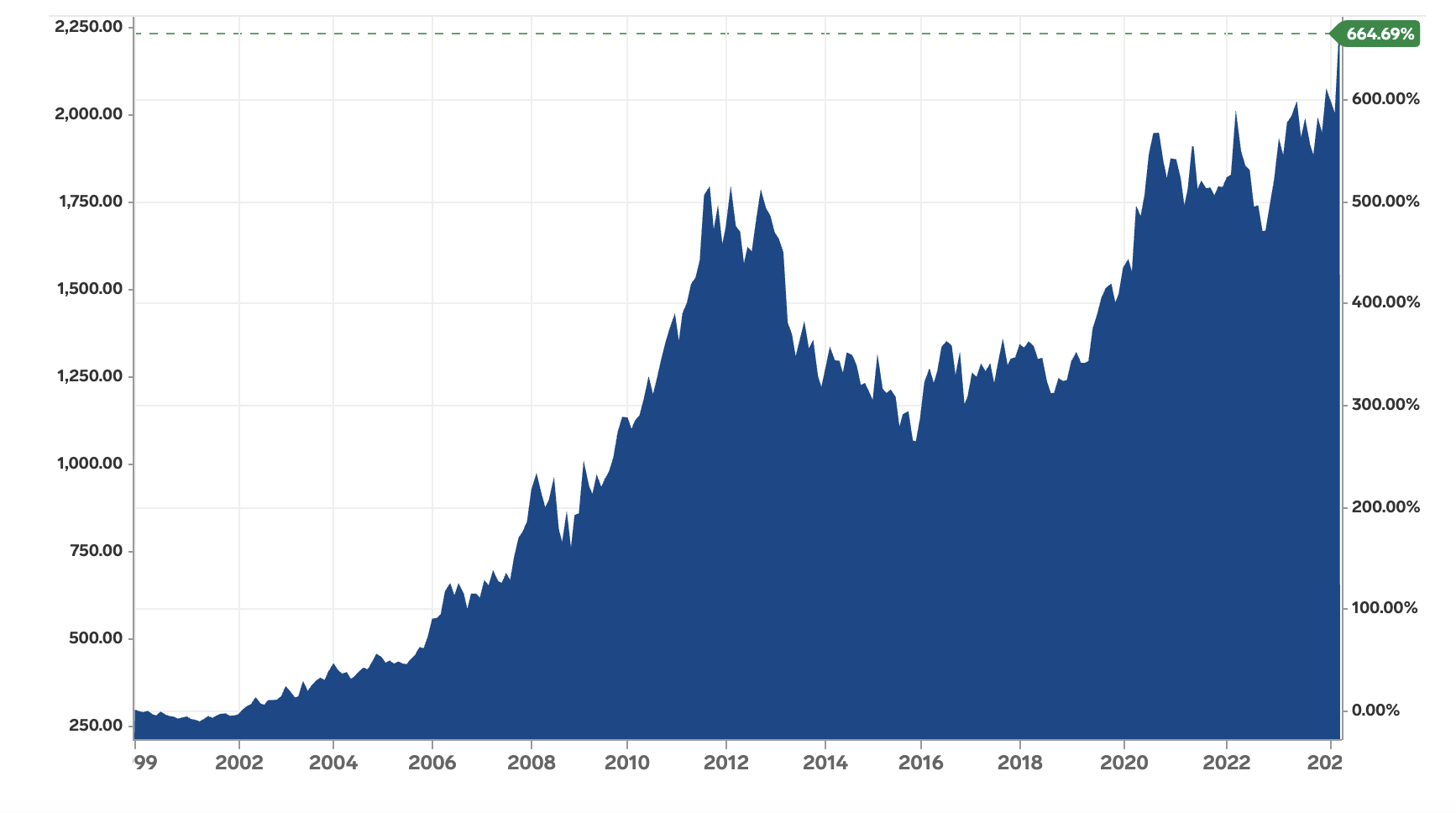

Amidst ongoing global economic uncertainty, gold is reaching unprecedented highs across all major currencies.

The shift occurs against a backdrop of escalating geopolitical risks worldwide, alongside increasing indications from central banks that rate cuts could be coming shortly.

More and more investors are starting to get position.

David Einhorn, the hedge fund manager at Greenlight Capital, has voiced concerns about enduring U.S. inflation, indicating that reducing inflation could prove more difficult than investors expect. Contrary to general expectations, Einhorn forecasts “fewer than three” interest rate reductions by the Federal Reserve within this year.

In light of his worries about inflation and possible market declines, Einhorn is bolstering his gold investments, considering it a safeguard against loose monetary and fiscal policies. Greenlight Capital holds a substantial stake in gold, encompassing physical bars and a $74 million investment in the SPDR Gold Trust fund.

Great Pacific Gold (TSX-V: GPAC)

Great Pacific Gold remains focused on progressing its portfolio of projects within Australia and Papua New Guinea, two countries renowned for its high-grade projects in the gold mining industry.

Led by a world-class team with a proven track record of developing companies from their early stages through to production, Great Pacific Gold is well-positioned for significant success in this exciting gold market.

The company recently unveiled impressive high-grade gold assay results from its initial follow-up diamond drill at the Comet gold discovery, located within the Lauriston Gold Project in Victoria, Australia.

Additionally, the company plans to conduct drilling operations at its projects in Papua New Guinea in the upcoming months.

There is a lot to look forward with this story in months ahead as the company is one significant drill hole away from unlocking significant wealth for shareholders.

Today I am pleased to be joined by the companies CEO, Bryan Slusarchuk, to provide another update on the company:

Alex Deluce:

Hi Bryan,

Thank you for providing another update to the Gold Telegraph community about the exciting developments in the Great Pacific Gold story.

How are things going, can you provide a general update on the company?

Bryan Slusarchuk:

It is an exciting time for the company in both Australia and in Papua New Guinea.

In Australia, we have just made an exceptionally high-grade gold discovery with an RC rig and we are following up on that discovery hole, which assayed an eye-popping 5 metres at 166 g/t gold including 2 metres at 413 g/t gold, with diamond drilling. The first diamond hole hit a high-grade intercept grading 4 metres at 25.1 g/t gold and we are now awaiting results from two additional holes. One of these holes we are waiting for started out as a hole with an intended target depth of approximately 150 metres, but was drilled to 255 metres before terminating, because stacked zones of mineralization were encountered. So, we think these next holes now being assayed have the potential to not only produce some more high-grade results but to also indicate some size potential to the discovery.

Meanwhile in PNG, a place close to my heart after having had involvement in the industry there over the past decade, we have just wrapped up a large soil chemical sampling program at our Kesar Creek Project which is north west of and contiguous with K92 Mining’s tenements and we have also been constructing drill pads and rehabilitating access at our Arau project which is to the south east of K92 Mining. We anticipate drilling at Arau in the very near future. We also hope to have some news about our Wild Dog project in the coming days and weeks and I think there is a lot to be very optimistic about there based on the very successful but limited historic work including drilling done in that area.

Alex Deluce:

In late 2023, the company made a significant discovery on your land package in Victoria, Australia. Could you provide more details on this discovery and explain what actions the company plans to take to build upon this exciting find in 2024?

Bryan Slusarchuk:

It’s hard not to be excited about the grade at the Comet Discovery and we believe that these next holes have the potential to reinforce some excitement about grade and add a dimension to the story relating to size upside. It’s not just the grade that is impressive but also the fact that this high-grade gold discovery occurred in the right place structurally speaking. The discovery, as you know, occurred where the western dipping faults intersect the anticline, and we are very eager to continue drilling. 2024 at Comet will be very drill centric as we advance the discovery forward.

Alex Deluce:

Last year, the company acquired a substantial land package in Papua New Guinea, a country where you and the GPAC team have a proven track record of creating value for shareholders.

For our new readers, could you talk about this asset and the drilling program scheduled for 2024? Additionally, what should investors watch for regarding this asset throughout the rest of the year that is exciting you and the team?

Bryan Slusarchuk:

I first went to PNG, of course, with K92 Mining where I was fortunate to be a co-founder and President and Director from the inception of the company through to cash flow positive mining and processing operations.

PNG is known in mining circles as the land of giants for good reason, and it is home to some of the most amazing geology on the planet. We have three key projects in PNG, as mentioned, being Kesar Creek, Arau and Wild Dog.

These projects are all at different stages with Arau and Wild Dog being drill ready while at Kesar Creek, we have just completed a big first pass geochemical survey. We intend to advance all of these projects through drilling in 2024 and the drill will be turning in the coming weeks at Arau to kick that off.

Alex Deluce:

Could you discuss your balance sheet and discuss if your 2024 programs are fully funded?

Bryan Slusarchuk:

We have a strong balance sheet with approximately $10 million in cash and are fully funded for 2024. We have a strong institutional registry for a company with a small market capitalization, but I think that market capitalization has the potential to increase significantly with good execution on the ground. We have the right type of shareholders who have had a lot of success backing our exploration efforts in the past and they can grow with the company as we get bigger via drilling.

Alex Deluce:

Finally, Bryan, with your extensive experience in the mining industry, you’ve witnessed many peaks and troughs.

Could you share your current perspective on the commodity/mining sector, and how can a company like GPAC, which is gearing up for an exciting drilling season, leverage this environment?

Bryan Slusarchuk:

I have never been as excited as I currently am with regards to the macro set up for gold and copper. And, with multiple high grade gold targets and with serious additional copper-gold porphyry potential at Arau and Wild Dog – we are well positioned for this environment.

I have remained very focussed on the sector during the past several years and I think groups like ours who have stuck with the sector despite some imperfect overall market conditions will be first movers to the upside when market interest returns which we are definitely starting to see across the sector now.

Legal Notice / Disclaimer

The Gold Telegraph, goldtelegraph.com, hereafter known as Gold Telegraph. Any Gold Telegraph document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Telegraph has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Gold Telegraph makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Telegraph/Author only and are subject to change without notice. The Gold Telegraph/Author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, The Gold Telegraph/Author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this The Gold Telegraph/Author report. The Gold Telegraph/Author is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading The Gold Telegraph/Author articles, you are acting at your OWN RISK. In no event should The Gold Telegraph/Author be liable for any direct or indirect trading losses caused by any information contained in The Gold Telegraph articles. Information in Gold Telegraph/Author articles is not an offer to sell or a solicitation of an offer to buy any security. The Gold Telegraph/Author is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Great Pacific Gold is a paid advertiser on the Gold Telegraph. The author does own shares of Great Pacific Gold (TSX-V:GPAC.)

This is not a recommendation.