One of Brazil’s most promising copper and gold projects at the development stage is preparing for an eventful 2024.

With all the necessary pieces aligned, Meridian Mining is positioned to enhance shareholder value significantly.

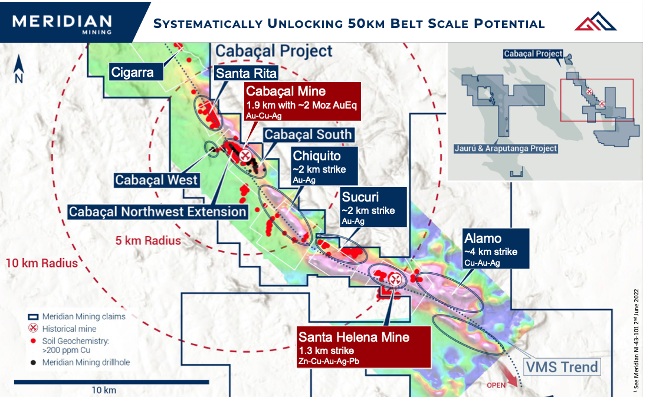

The company is progressing with the Cabaçal deposit, which shows excellent promise as a standalone mine in the extensive 50km VMS belt.

As top global financiers express concerns that we are heading towards major deficits in numerous commodities, the focus intensifies on the essential need for an increased supply of minerals, especially copper, to propel the green energy transition forward.

BlackRock, the largest asset manager, has warned against investor hesitancy in the mining sector.

The firm cautions that this cautious approach could sever vital funding streams, critically endangering the energy transition by precipitating a shortfall in metals crucial for advancing green technologies.

Meridian Mining’s project, characterized by world-class economics, is advancing a substantial copper/gold VMS deposit. This project boasts a significant scale and holds great potential for further expansion.

The Cabaçal Mineral Resource features an Indicated resource of 52.9 million tonnes, hosting 1.1 million ounces of gold, 168 thousand tonnes of copper, and 2.4 million ounces of silver.

Additionally, its Inferred resources add 10.3 million tonnes, with 0.2 million ounces of gold, 24.5 thousand tonnes of copper, and 0.4 million ounces of silver. The total gold equivalent is 1.8 million ounces for Indicated and 0.3 million ounces for Inferred resources.

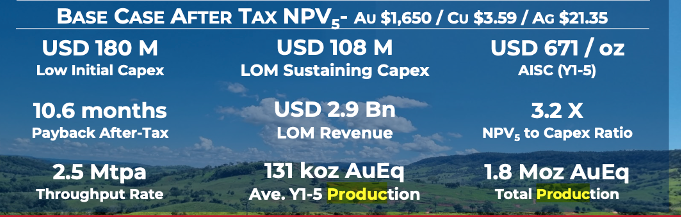

However, as mentioned previously, the economics of the project are world-class:

The project’s after-tax NPV is a robust USD 180 million, with low initial Capex and an extremely quick 10.6-month payback period.

Annually processing 2.5 million tonnes, it’s projected to yield USD 2.9 billion in the life of mine revenue, with a sustaining Capex of USD 108 million.

Estimated annual production for the first five years averages 131,000 ounces of gold equivalent (AuEq), with a highly economical all-in Sustaining Cost (AISC) of USD 671 per ounce, signifying strong early profitability.

The company recently appointed Bruce McLeod as the chairman of its board.

Widely recognized in the mining sector, Mr. McLeod previously held the position of President and CEO of Sabina Gold & Silver Corp., which B2Gold Corp. acquired in April 2023 for an impressive C$1.2 billion.

Mr. McLeod stated, “After spending several months reviewing Cabaçal and meeting with Meridian’s team, I am convinced that Cabaçal has the fundamental attributes necessary to become a copper-gold producer.”

That is a powerful endorsement.

With these developments in mind, I recently had the opportunity to sit down with the company’s CEO, Gilbert Clark, to offer Gold Telegraph readers an overview and an introduction to the company.

Alex Deluce:

Hi Gilbert, I appreciate your time today for sharing insights with Gold Telegraph readers about the captivating journey of Meridian Mining.

To begin our discussion, could you give us an overview of the advanced-stage Cabaçal gold-copper-silver rich VMS deposit the company is developing?

Gilbert Clark:

Thanks Alex, and it’s great to provide this introduction to the Gold Telegraph readers today.

Meridian is developing the Cabaçal project to become the next gold and copper miner in Brazil. The Preliminary Economic Assessment outlines an attractive stand-alone project with an initial valuation of over CAD one billion dollars at spot prices. The Cabaçal belt is named after the Cabaçal deposit that was originally discovered in the 1980’s, operated for a short time and then it was hidden from the public markets for almost 30 years until we secured it in 2020. Essentially, we secured the exploration upside of a plus 50km copper-gold-silver VMS belt where the low hanging fruit of opportunity is essentially intact. This prospectivity is further enhanced by a later stage geological event that has overprinted the VMS system with additional gold; this can provide high grade gold zones within the deposit.

Alex Deluce:

The company published a remarkable PEA on the project last March, which showcased superior economics at the Cabaçal project. Can you touch on that, in particular, how it compares to recent gold project economic studies?

Gilbert Clark:

Cabaçal’s PEA introduced something that has been absent from the mining industry capital markets for some years: A large VMS hosted gold-copper open pit deposit that generates robust stand-alone economics using industry standard conventional mining and milling processes. Brazil’s low cost operating environment make for a low capex and opex project which can repay the initial capital cost in under 11 months, which is incredibly low for an industry that usually does not repay capital for several years. In addition, the project’s exceptional metallurgy, high-grade starter pits, and low strip ratio allows for the highly profitable development scenario shown in the PEA.

We believe that the Cabaçal mill has the potential to act as a “hub” for the entire belt, and that our neighbouring deposits could truck the mineralization to this central hub. Like many of the world’s VMS belts we are confident that the Cabaçal belt will start at the Cabaçal mine and then have a production lifespan measured in decades.

Alex Deluce:

Could you elaborate on the exploration potential of the 50km belt at the project?

Additionally, how extensive is the exploration drilling planned for this year, and could you also shed some light on the significant Iron Oxide Copper Gold exploration target?

Gilbert Clark:

In my opinion the potential of the Cabaçal’s 50km VMS belt is unlike anything I have seen in over 25 years in the mining industry; having a junior company to control a belt. To date we have only just scratched the surface, testing two of the seven identified hydrothermal centres of the belt, that will take many years to fully explore all of the upside.

Beyond the Cabaçal project, for the next year we will focus on the eastern expansion of the Santa Helena’s mine prospectivity. Here we have over 2km of geophysical and geochemical anomalies that need to be systematically tested. Between the Cabaçal deposit and the Santa Helena mine there is a 9km zone called the mine corridor, that has geophysical and geochemical targets that need to be evaluated, ranked, and then tested by drilling. The key to the Cabaçal belt’s upside is that we are looking to prove up more resources of open-pitable mineralization and continue the success of the Cabaçal deposit. We are currently going through the 2024 budget review, but I expect the exploration budget to include a robust exploration drill program.

Our Espigão Iron Oxide Copper Gold, or “IOCG” project is part of a larger review of our historical exploration portfolio of future-facing metals that is being evaluated through a Strategic Review process to maximise value for shareholders. We hope to update our shareholders and the market on this in early 2024.

Alex Deluce:

What key catalysts should investors pay attention to from the company for the rest of the year?

Gilbert Clark:

With our ongoing drill program, investors should look out for further assays being released. With continually good results coming out of Santa Helena from shallow depths, building to what we expect to be the next open-pitable resource within the Cabaçal belt.

At Cabaçal, potentially more assays and we have the upcoming update on the results from the metallurgical repeatability testwork program. This will be included in our updated resource estimate and PEA, which is focused on a larger throughput scenario for Cabaçal.

Alex Deluce:

Lastly, Gilbert, could you share your current perspective on the junior mining market, especially regarding gold, silver, and copper?

Additionally, how do you perceive the current market sentiment compared to your career experiences?

Gilbert Clark:

As we all know the market sentiment has been very tough for the resource stocks, and there are many good companies with strong projects where their valuations have been driven down to ridiculous levels. In my opinion, we are poised for the junior mining market to make for an exciting future growth story and rebound going forward.

The handy thing for investors concerning copper, gold and silver is that these all have known metrics for estimating a valuation and determining if a project is a viable hard asset or simply a small cap promote. At Cabaçal we have delivered on a material hard asset with a platform for future growth. When I look at the global pipeline of actual viable gold-copper deposits it is very thin, and mostly they are short lived projects or have prohibitively large capex for a junior to develop

Finally, Alex, I see the current public market for resource stocks very much like the late 1990’s, with overpriced tech stocks and greatly undervalued resource stocks. This time, though, I don’t think we will be waiting years for next cycle to commence; there are almost no new mines coming online in the near or long term.

Legal Notice / Disclaimer

The Gold Telegraph, goldtelegraph.com, hereafter known as Gold Telegraph.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the Gold Telegraph Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this Gold Telegraph website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any Gold Telegraph document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Gold Telegraph has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Gold Telegraph makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Telegraph/Author only and are subject to change without notice.

The Gold Telegraph/Author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, The Gold Telegraph/Author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this The Gold Telegraph/Author report.

The Gold Telegraph/Author is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading The Gold Telegraph/Author articles, you are acting at your OWN RISK. In no event should The Gold Telegraph/Author be liable for any direct or indirect trading losses caused by any information contained in The Gold Telegraph articles. Information in Gold Telegraph/Author articles is not an offer to sell or a solicitation of an offer to buy any security. The Gold Telegraph/Author is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

The author does own shares of Meridian Mining (TSX-V:MNO). Meridian is a paid advertiser on the Gold Telegraph.