*SolGold is a client of the Gold Telegraph

With gold and copper starting to break out, SolGold is rapidly gaining recognition as a standout developer in the mining sector.

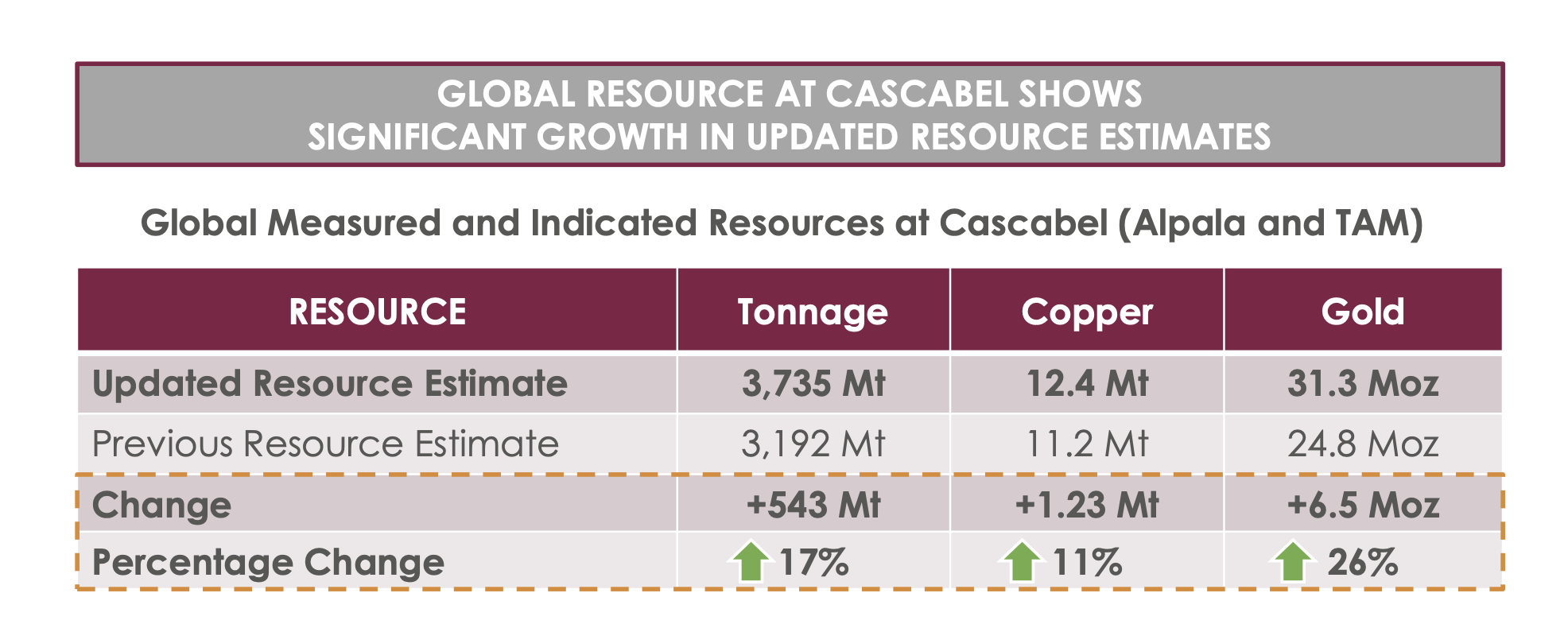

SolGold (TSX: SOLG | SOLG.L) has a world-class tier-one copper and gold asset, which hosts 12.4 million metric tons of copper and 31.3 million ounces of gold.

Anchored firmly in Ecuador’s rich geological grounds, the company’s Cascabel project emerges as a transformative force set to lead the country to be a significant player in the mining industry.

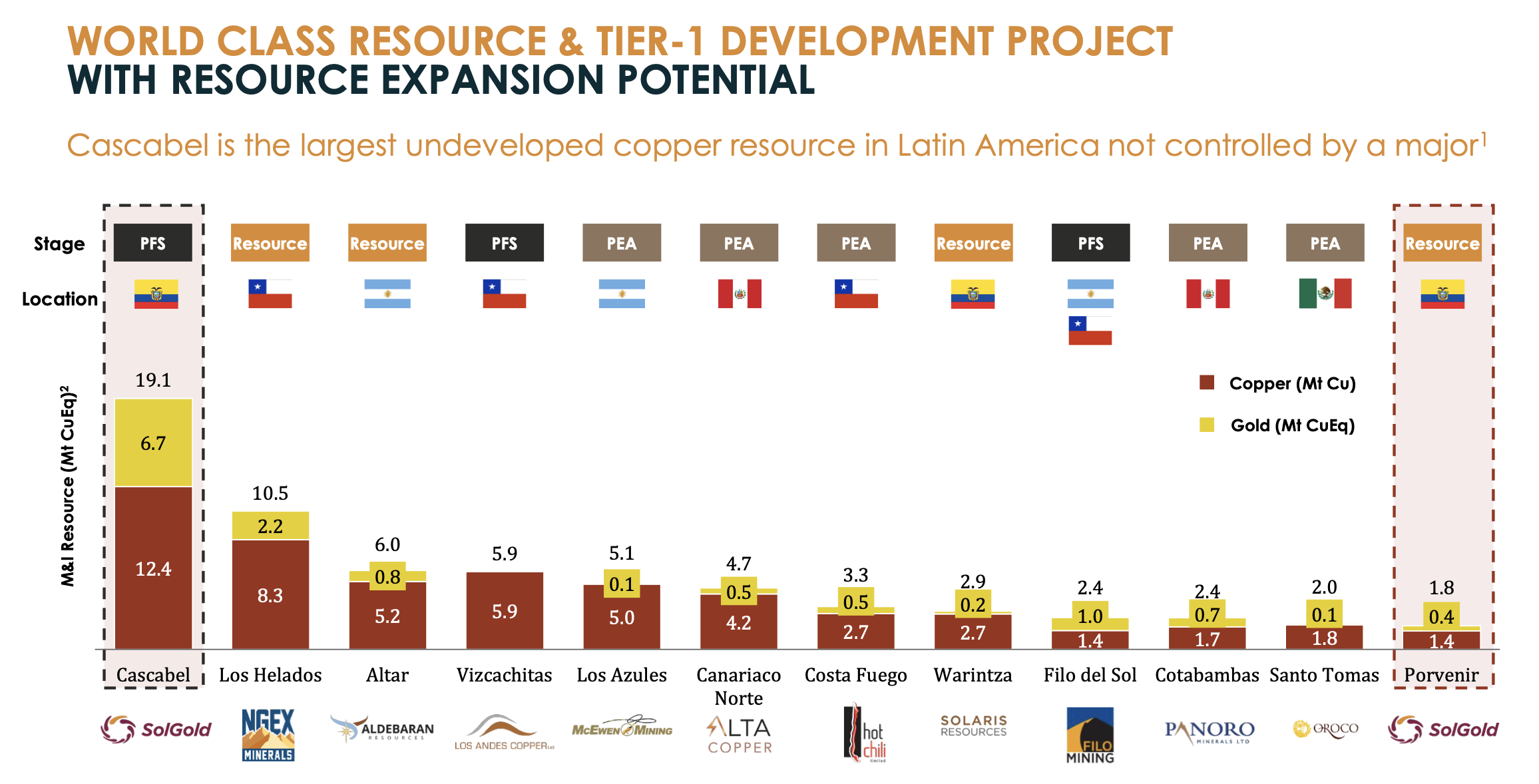

This tier-one asset is one of the only projects at this scale that a global, multi-national mining company does not own.

Cascabel is also the largest undeveloped copper resource in Latin America, not controlled by a major, and is trading at a significant discount vs. its peers.

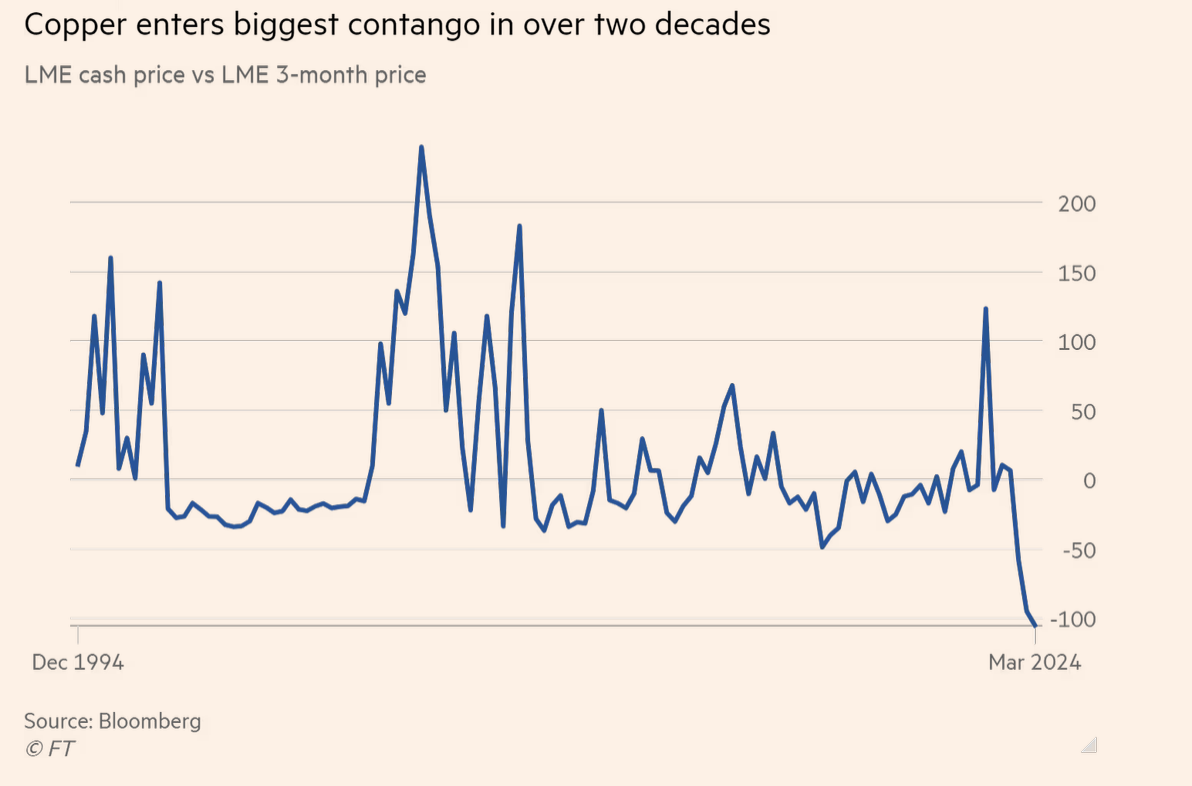

This asset is increasingly capturing the attention of the market as global traders start to brace for a shortage of copper in the near future. In fact, the difference between spot price and future delivery is the largest ever, according to records dating back to 1994.

Goldman Sachs forecasts copper prices to soar to $10,000 per tonne by year-end, driven by strong demand from China and persistent disruptions on the supply side.

This potential scenario positions SolGold very well, offering investors the opportunity to leverage the expected price surge for copper and gold, with the gold already trading at record highs in USD terms.

The company’s wholly-owned asset hosts tens of billions of dollars worth of these minerals, priming SolGold for significant growth in this bullish commodity market.

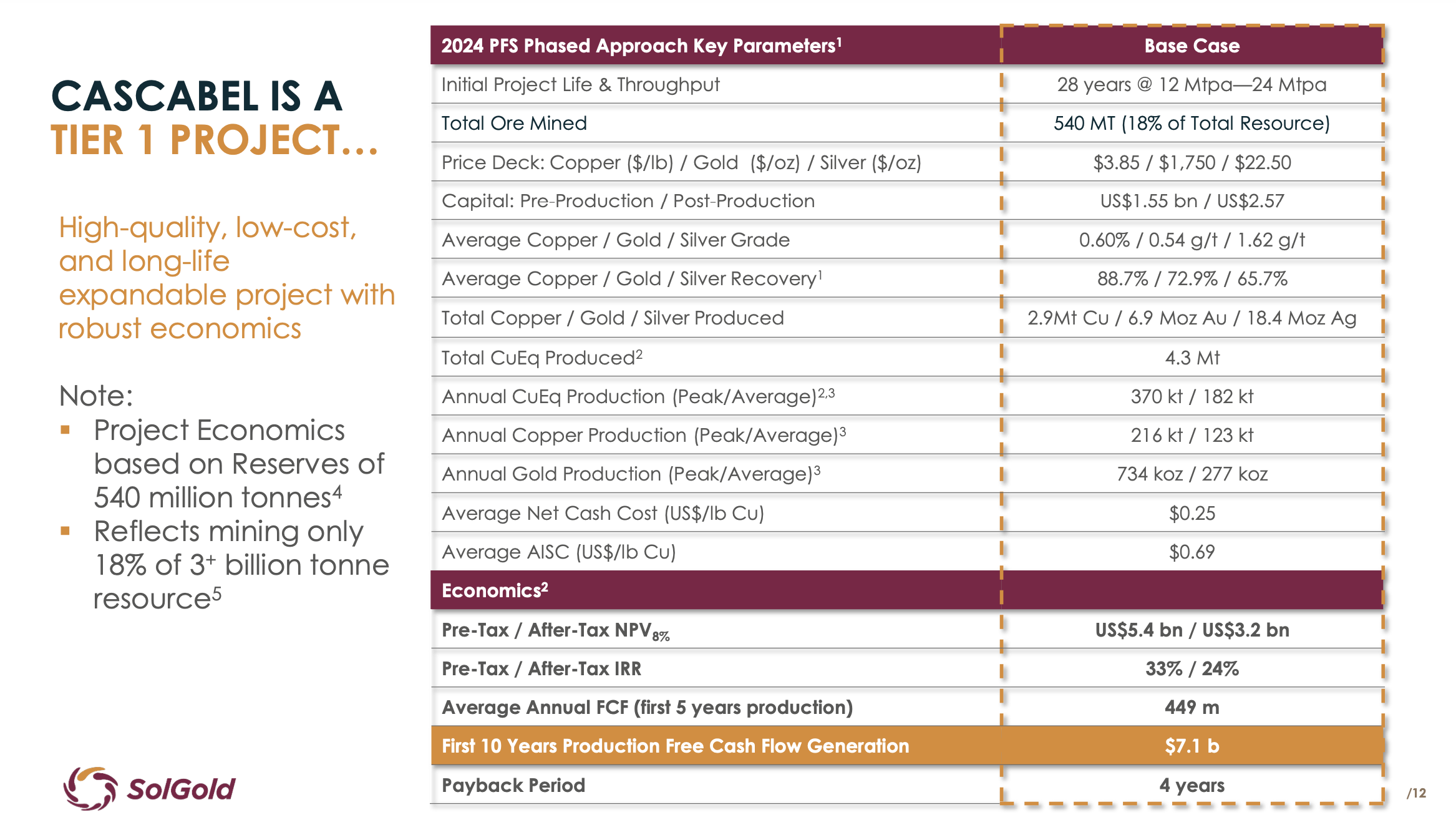

The company recently published a pre-feasibility study on this project and showcased the robust economics that this project represents.

Spanning a projected 28 years, the mine’s life is poised to initiate a block cave operation that boasts a robust after-tax net present value (NPV) of US$3.2 billion and an internal rate of return (IRR) of 24%.

The upfront capital expenditure (CAPEX) is set at US$1.55 billion, a significant but strategic investment in the mine’s robust economic potential.

Once in full operation, Cascabel is expected to yield an average annual production of 123,000 metric tons of copper, 277,000 ounces of gold, and 794,000 ounces of silver.

This production not only signifies a substantial yield of precious and industrial metals but also underscores the project’s capability to become a cornerstone of the industry for decades to come.

In the coming months, I’ll be bringing you a series of updates on SolGold, but for today’s highlight, I’m delighted to welcome Scott Caldwell, the CEO of SolGold, who will share the latest developments within the company and offer an introduction to the unique prospects of SolGold for the Gold Telegraph audience.

Alex Deluce:

Scott, thank you for joining me today and introducing the story to the Gold Telegraph community.

SolGold has had a lot going on in the last few months, and with Copper starting to make a move, it’s certainly a story I wanted to get in front of my readers. We’re excited about the update.

So, to start, you could give an overview of SolGold and the tier-one asset that the company owns 100%.

Scott Caldwell

Sure, thank you, Alex.

SolGold, maybe a little bit about when I first got involved in the story: I visited the Cascabel site and the Alpala deposit in 2016, looked at kilometres of core, and recognized that the SolGold team had made a world-class discovery at the Cascabel project with the Alpala deposit.

It’s just kept growing over the years, and it’s now one of the largest, if not the largest, undeveloped copper-gold porphyry projects in the world that a major does not control.

It is very large, with over 30 million gold ounces and 14 million tons of copper. So it’s a huge, very rich, high-grade deposit, world-class or tier one, as you could say. So, I’m excited about that discovery.

The company itself has the largest land portfolio in Ecuador and exploration properties throughout the country; I’m convinced that there’s another discovery out there. We’ve made one at Porvenir, a porphyry copper-gold project.

I know there’s another discovery out there, but our focus is now to de-risk the Cascabel project.

By that, I’m talking about getting our permits and right-of-way and getting it ready for construction so that it can be de-risked.

I’m really excited about the future for SolGold.

Alex Deluce:

Thanks, Scott.

The company recently reported a very promising pre-feasibility study, which revealed considerably lower initial capital costs, highlighting the project’s robust economics. Can you provide more details on that and what you and the team think about the recently reported study?

Scott Caldwell

Yeah, it was a pretty simple concept.

It was just looking at the deposit, it’s huge.

It’s three billion tons of ore. It’s a generational project, starting out small with a lower upfront capital cost of only $1.55 billion.

It’s funny when I say “only” to that number, but a little over half of the previous study’s capital costs, improved IRR, and improved NPV.

All of our stakeholders have received the study very well. This includes shareholders, the local communities we work in, and the government of Ecuador.

It’s lower risk because of lower upfront capital, shorter development schedule by a year to get into production.

But a simple concept, start out smaller and we gradually work our way through operating cash flow after the initial capital, back to about 24 million tons planned production per year.

We will mine the higher-grade material; it’s a deposit such that we don’t sterilize other materials. So, this is a generational asset. It will be around for 50, 60, 75 years, producing copper and gold in an environmentally friendly manner.

I am very excited about the project, its better economics, shorter development schedule, lower risk because of a lower upfront capital cost.

Alex Deluce:

The company recently issued a statement about its collaborative agreement with the Ecuadorian government, marking a significant advancement in readiness for the execution of the additional investment protection agreement designed specifically for the Cascabel project.

Scott, could you take a moment to highlighting the details of this news release and its implications for SolGold?

Scott Caldwell

Sure.

This was during the PDAC in early March. Ourselves and five other companies signed a similar, if not identical, agreement working through the amended investment protection.

And what that is is we will have two once the final signing of the second agreement is done.

We’ll have one for the historic capital investment. And what that does is it ensures that we would go through a proper arbitration process, etc, if there were some issues which we, of course, don’t anticipate.

Then, we’ll also have an agreement for future capital. So the 1.5 billion I mentioned plus the sustaining capital we would invest. And so we’re excited about those agreements.

Now, we are focused on obtaining permits and de-risking the project.

All of it’s further de-risking for all of our stakeholders, not just the company, but also for the Ecuadorian government and moving this project forward.

Alex Deluce:

Scott, having joined SolGold two years ago, you have had success with various companies. Reflecting on the diverse projects you’ve undertaken, what has your personal experience been like in Ecuador?

Moreover, how do you feel about the country’s prospects concerning mining and the initiation of new projects?

Scott Caldwell:

Yeah, I live in Quito now, so I live in Ecuador, and I spend three-quarters, if not more, of my time in Ecuador.

And I really enjoy it despite all the press about the issues with the drug cartels on the coast and that situation, but I feel very safe. I walk to work; I walk back from work every day. There are no issues where we’re working, in the South, at Porvenir and up North at Cascabel. So very safe for us in a good place to work.

And Ecuador, I think if you go back, if you really look at the grassroots side, it has the geology, it has the rocks, and you look at Fruta del Norte, which Ron and his team, and they’ve done such a great job with Lundin Gold.

You look at Mirador, which is owned and operated by the Chinese, that’s a big porphyry copper open pit mine.

So Ecuador is open for business.

The most important thing, if you’re in the extractive copper gold industry, is its great rocks, meaning we’ve got a wonderful discovery in Cascabel.

There are numerous other discoveries in the country and companies that are moving forward. So things are going well. I think it’s a great place to work and we’re excited about it.

I think the current administration under the leadership of President Noboa is doing a great job.

We are excited about what the future holds for us.

Alex Deluce:

SolGold has successfully drawn the interest of world-class strategic shareholders over the years.

Scott, please discuss some of the prominent shareholders currently invested in SolGold and highlight those who have been captivated by the company’s potential in recent years.

Scott Caldwell:

Sure.

As you mentioned, if you look at the strategics, the large mining companies that are involved in the project, you have BHP, which has been in the project for quite some time.

Their first investment would’ve been around 2018 or 2019, something in that timeframe. You have Newmont, which acquired Newcrest, and Newcrest was very early days in the project. I’ll say 2016 or 2015, but very early days that they invested.

Both of those companies, approximately, each own about 10.3% of the company. And then our third strategic investor is JCC, Jiangxi Copper Corp. They own about 6% of the company.

So we have three majors that are obviously interested in the project and

wouldn’t be in SolGold if they didn’t at one time think this was a great tier-one generational asset; otherwise, they wouldn’t have invested in SolGold.

It’s big, and it’s high grade.

Alex Deluce:

Well, it’s great to have that endorsement from such huge players in the space, notably in copper.

I was curious, given your industry experience of seeing many different cycles play out, what your general perception or thesis is on the general copper and gold space?

Scott Caldwell:

Yeah, I started my career in copper 40-odd years ago.

I’ve always been either in copper or gold. I’ve always been a big, big fan of copper.

The renewable energy, the transformation, and the decarbonization that we all talk about in the world’s energy supplies will happen.

I realize that the EV and the electric vehicle sales aren’t what people projected, but there still is a big deficit brewing in copper.

You look at countries such as India, other economies in Africa, where you need copper, copper connects everything. So, I’m very bullish on copper. I’m also bullish on gold.

I really believe that the political instability, I’ll say, you’ve got the Gaza situation, the horrible things there, you’ve got Ukraine, etc.

So, gold is still perceived as a safe haven by people far more sophisticated and smarter than me. But I’m a believer in gold as well. But the company I lead is a copper mine with a great gold credit, 30 million ounces of contained gold.

And so, it will produce both metals and some silver, but it’ll always be the greater value in copper.

But copper is going to have a great run, here, and I’m excited to see the price moving up, but we’re a few years away from production.

But I think there’s going to be a great demand for copper in the future. And EV sales aside, I think there’s going to be a lot of people buying copper and using copper to expand their economies.

Legal Notice / Disclaimer

The Gold Telegraph, goldtelegraph.com, hereafter known as Gold Telegraph. Any Gold Telegraph document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Telegraph has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Gold Telegraph makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Telegraph/Author only and are subject to change without notice. The Gold Telegraph/Author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, The Gold Telegraph/Author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this The Gold Telegraph/Author report. The Gold Telegraph/Author is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading The Gold Telegraph/Author articles, you are acting at your OWN RISK. In no event should The Gold Telegraph/Author be liable for any direct or indirect trading losses caused by any information contained in The Gold Telegraph articles. Information in Gold Telegraph/Author articles is not an offer to sell or a solicitation of an offer to buy any security. The Gold Telegraph/Author is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

SolGold is a paid advertiser on the Gold Telegraph.